Cheques (& How to Write One)

664

664

What are cheques?

A cheque (or check) is a paper used to give money from one person or business to another person or business. It can sometimes be used as payment instead of cash or credit.

When you write a cheque to someone, that person/business' bank will then inform your bank that they owe them the amount you wrote on the cheque. The bank will make sure the cheque is good, you have the amount in your bank account, and will then be taken out of your bank account. If there's a problem with your cheque then the bank will hold it.

Cheques are not as popular as they once were, though there are still some places where they can be used.

Where can I get cheques?

You can get cheques from your bank or credit union. As long as you have a chequing account, your bank will give you a bunch of cheques (usually called a cheque book).

Where can cheques be used?

Though cheques are not as common as they once were, there's still many that are used in Canada. You will likely still get paid by cheques, though it is usually done by direct deposit now.

If you are paying by cheque, it must be written to a person or business. A cheque that is written to a person/business but does not have the amount of money written on it is called a blank cheque.

Though many businesses no longer take cheques, you can still use them to pay for bills and income taxes.

Are cheques safe to pay with?

Yes! Cheques are absolutely safe! Canada has one of the safest cheque clearing processes in the world.

The banks within Canada have many strategies to prevent fraud cheques. Still, it is best to keep your cheques someplace safe to prevent any problems.

Common problems you may have to face with cheques are:

Non-sufficient funds (NSF) cheques

This is when you write a cheque and you don't have enough money in your account, so the bank will cancel the cheque.

Stop payments

If you lose your cheque or its stolen then go to your bank and ask them to stop the payment. You usually have to pay them a few and tell them:

- The cheque number

- exact amount in dollars and cents

- name of the person or merchant on the cheque

- date that appears on the cheque

Counter-signed cheque

This is a kind of cheque that can be cashed by someone else, so long as they sign their name on the front or back. To protect against someone doing this without your permission, write “for deposit only to account of payee” on the back of your cheque.

Stale-dated cheques

Cheques have an expiry date (usually 6 months). If you pass the expiry date to despair the cheque then that is called a stale-dated cheque. Banks don't have to take a cheque that is past its expiry date (though they may).

Post-dated cheques

You must write the date when you use a cheque. If you write a later date, you can't use it until the date that you wrote on it. This is called a post-dated cheque.

Dishonoured cheque

When a cheque doesn't go through and cannot be paid. Common reasons include:

- non-sufficient funds (NSF) in your account

- Irregular signature, meaning your signature on the cheque is different from the sample signature in the financial institution

- A difference between the amount written in words and the amount written in numbers

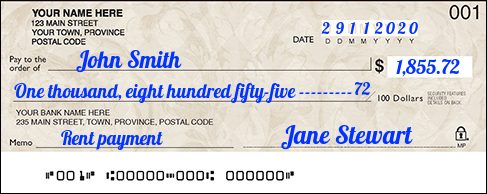

How to write a cheque

*always write a cheque with blue or black pen

- Write the date in the top right corner, next to a box or line that says “Date.” Always write the same date as the date that you signed the cheque.

- Write the recipient (who's getting the cheque) on the line next to “Pay to the order of.” If it’s a person, write their first and last name. If it’s a company, make sure you have the company name that’s used for payments. You can also write ‘cash’ here, and that means anyone can take the cheque to the bank and take the cash from your account.

- Write the amount you want to pay in numbers next to the dollar sign ($).

- Write the amount you want to pay in words. Although not legally required, you should spell out the dollar amount in words on the line beneath the recipient, including the cents as a fraction like 25/100 or 89/100. This helps the bank understand the amount you want.

- Sign the cheque. In the bottom right corner there is a space for your signature. If you don’t, it won’t be valid.

- Fill out the memo section (optional). Here, you can write what the cheque is for like rent payment, reimbursement for business expenses or security deposit. This part isn’t required,l but can be useful for record keeping.

A fully completed cheque should look something like the one below. Remember the memo field is optional. But make sure you remember to sign the cheque!